Weekly Briefing, Vol. 38, No. 2 (LVA), March 2021

Impact of the Covid-19 pandemic on the business environment in Latvia

Introduction

In 2020 and 2021, in addition to the usual obstacles to business development, entrepreneurs have faced a huge challenge – the Covid-19 pandemic, which has introduced significant changes in the usual business environment. Unfortunately, various restrictions that hinder the development of the business or even stop it completely influenced the intention to start up or to maintain existing business.

According to the latest data, the number of enterprises registered in Latvia in 2020 reduced significantly, but the number of liquidated companies did not increase, on the contrary, it considerably dropped. The reasons for these not obvious changes and other economic indicators of Latvian business environment are described in this briefing.

Dynamics of establishment and liquidation of enterprises in Latvia

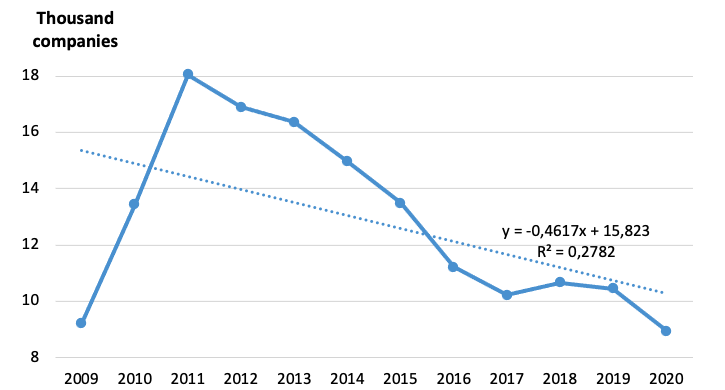

One of the direct indicators of the business environment in the country is the number of companies registered per year:

Figure 1.Dynamics of number of companies registered in Latvia (2009 – 2020)

Source: Image developed by the author using Lursoft data and calculation results

As it can be seen in Figure 1, the number of companies registered in 2020 even less than it was in the years of the severe financial crisis in the country (2009-2010), meaning that people now even less confident than it was ten years ago. It can be explained that the uncertainty brought by Covid-19 is tougher than ever before and people are afraid to start up. Also, the Covid-19 pandemic was unexpected for society, which creates even more doubts from the side of the population regarding the future of the country’s economy.

In comparison with 2019 there were 14,4% less companies registered in 2020, which is a significant decline that is already causing and will be able to cause an even more sharp decline in the economic indicators in the following years.

The next indicator characterizing the business environment is the number of liquidated companies in Latvia. However, the statistics here are not so obvious, and the comparative data in the Table 1 require additional analysis and commentary.

Table 1

Number of companies registered and liquidated in Latvia (2019-2021)

| Year | Registered | Liquidated | Proportion, %[1] |

| 2019 | 10 444 | 23 857 | 228,4 |

| 2020 | 8 939 | 11 687 | 130,7 |

| 2021 | 1 680 | 3 442 | 204,9 |

Source: Image developed by the author using Lursoft data[i] and calculation results

In the first year of the pandemic 2020, the number of liquidated companies significantly decreased, which is explained by the introduction of the simplified liquidation process performed by the Register of Enterprises for high-risk companies, excluding from the register companies that have not identified the true beneficiaries or does not carry out an economic activity.[ii] The majority of enterprises related to this cause of liquidation were terminated in 2019, which is the explanation of the high number of liquidated companies this year. However, the next year, 2020, has caused a considerably fewer number of liquidated companies, even though it was the year of pandemic and extremely tough conditions for business. The reason for it is the law “On Measures to Prevent and Overcome the State Threat and its Consequences Due to the Spread of Covid-19” promulgated on March 21, 2020, which stipulates, among other things, that as of 1 September, creditors were prohibited from submitting an insolvency application of a legal person.

Creditors have been allowed to file for insolvency of a legal entity again since September 2020, and as we can see the proportion of liquidated companies has increased again. Since the Covid-19 is still spreading uncontrollably and the restrictive measures influence the economic activity of Latvian companies and especially small and medium enterprises, a plethora of companies cannot survive in this reality. So, most probably the number of liquidated companies will only increase this year and the proportion of them as well.

Insolvency statistics

Figure 2. Dynamics of insolvency cases by type of enterprise in Latvia[2]

Source: Image developed by the author using Lursoft data and calculation results

The figure illustrates that during the financial crisis of 2009-2010 the number of insolvency cases was the greatest and the structure of enterprise types, initiated insolvency procedure differs significantly from today’s situation. At that time most of all insolvency cases were among legal entities and only 3% of all cases were among physical persons. Starting from 2011 the share of insolvency cases among physical persons started to increase and the biggest share of them was in 2020 – 57,3% (2021 was not counted), meaning that Covid-19 in Latvia influenced the most exactly this type of business. Again, the law “On Measures to Prevent and Overcome the State Threat and its Consequences Due to the Spread of Covid-19” reduced the number of insolvency cases but not as significant as the number of liquidated companies.

According to the first three months of 2021, the number of insolvency cases among physical persons is still growing, for now, it is 67,1% of all insolvency cases. Of course, small and medium businesses suffered a lot during the pandemic, a plethora of companies were not able to survive due to tough and continuous restrictions. The consequences of Covid-19 for the Latvian economy will be negatively reflected in the business environment for the next several years.

Direct investments in Latvia and abroad

The impact of Covid-19 on foreign direct investments (FDI) also will be felt for the next several years. The question is only how bad will it be? As Latvia is not the country, where Covid-19 has influenced the most. Even though the second wave severely hit Latvia, the post-Covid time can be attractive for foreign investors as Latvia can recover rather fast in comparison with other EU countries. To better understand how Covid-19 influence foreign direct investments in Latvia and abroad, the data from the Bank of Latvia used (see Fig. 3).

Figure 3.Dynamics of direct investments in Latvia and abroad (2009-2020)

Source: Image developed by the author using Bank of Latvia[iii] data and calculation results

According to Figure 3, direct investments in Latvia are gradually decreasing since 2018, and this trend most probably is not going to change in the following years. However, an even more emerging alarm is the increase of direct investments abroad, meaning that local investors more often than any year since 2015 prefer to invest in foreign projects rather than local ones. Despite the fact that FDI in Latvia are still bigger than investments abroad, this trend needs to be addressed directly as this source of a country’s income is one of the most important for Latvia. So, there is a strong necessity in the set of measures to prevent an increase of direct investments abroad and ensure the development and enhancement of relationships with foreign investors.

The biggest investments in Latvia in 2020 and 2021 are made by company CE-Beteiligungs-GmbH in the German supermarket chain Lidl, which is going to open this year. It is important to mention that for two years in SIA Lidl Latvia invested more than EUR 195 million, but the decision was made to postpone the opening until a safer and more stable situation with Covid-19. Also, SIA “Orkla Biscuit Production”, registered in May 2020, in the share capital of which the Estonian Orkla Eesti AS has invested EUR 10 million and the holding company SIA “Emteko Holding”, in the share capital of which EMTEKO LIMITED registered in Cyprus has increased its investment from EUR 34.09 million to EUR 131.48 million.

Summary

There are no doubts that Covid-19 significantly influenced the business environment in Latvia. Maintain everyday activities is still impossible due to a wide range of restrictive measures, at the same time the level of demand is decreasing in the various sectors of the economy as in difficult times people tend to save more and consume only products and services that are more important for them. However, private business is the most important source of income for the state and decreasing activity of this sector is leading to an economic recession in the country.

The number of enterprises registered in 2020 was almost 15% less than in 2019. Unpredictability and insecurity of people considerably decrease the attractiveness of starting up. To support enterprises government introduced the law “On Measures to Prevent and Overcome the State Threat and its Consequences Due to the Spread of Covid-19”, which consider certain tax reliefs and most importantly prohibited to submit an insolvency application of a legal person for creditors. Due to this law, the number of liquidated companies and insolvency cases were significantly lower than they could be.

Finally, the situation with direct investments in Latvia and abroad is worrying. As the investments in Latvia are decreasing, while investments abroad are increasing. Therefore, from both sides, Latvia receives less capital, and the consequences can be very dramatic unless a plan of action is created to attract more investors from abroad and prevent an outflow of local capital.

[1] Percent of liquidated companies / comparison with registered

[2] Data for 2021 represented for the first three months, number of insolvency cases for legal entities – 51, local insolvency cases for legal entities – 50.

[i] Lursoft statistika. (09.03.2021). LR Uzņēmumu reģistrā reģistrēto subjektu dibināšanas un likvidēšanas dinamika. Available at: https://www.lursoft.lv/lursoft_statistika/?&id=3

[ii] Dienas bizness. (12.10.2020). Biznesa vides veselība Covid-19laikā Latvijā. Avalable at: https://www.db.lv/zinas/biznesa-vides-veseliba-covid19-laika-latvija-499152

[iii] Bank of Latvia Statistical Database. (2021). 04 DI quarterly/ annual data tables (transactions). Available at: https://statdb.bank.lv/lb/Data/187/d9ecf2ea39adcadd80c96455a5452aee-html