Weekly Briefing, Vol. 68. No. 1 (CZ) December 2023

Politico-Economic Development in 2023: An Overview

Summary

The briefing provides an overview of the politico-economic development of the Czech Republic in 2023. The government policies were largely affected by economic factors, especially inflation and the energy crisis. The analysis, therefore, pays principal attention to fiscal and monetary policies and their interactions with economic realities. The briefing also addresses social consequences and declining public support for the ruling coalition. It concludes that the coalition’s main raison d’être is to prevent the opposition from assuming power.

Introduction

The government has failed to fulfil its goals set upon the accession to power in December 2021. Recent analyses show that the cabinet succeeded in implementing the programme commitments in 26 per cent of cases while it breached them in 16 per cent of cases and up to 22 per cent of the political goals have not been realised at all.[1] Moreover, the coalition has not prepared any fundamental reforms which are needed in such fields as economy, education or pension system. The volatile and unfavourable external environment which has had strong negative impacts on the Czech Republic has been accompanied by controversial measures which put basic rights and freedoms in danger.[2] Overall, the socioeconomic conditions deteriorated in 2023.

The government and fiscal policy

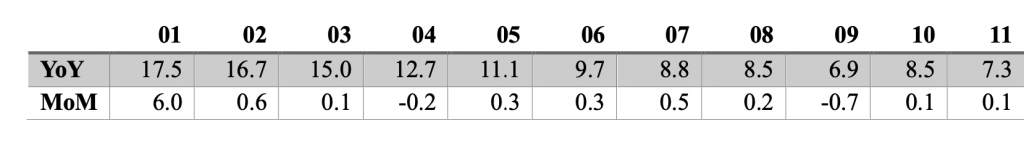

The government and central bank have had to cope with very high levels of inflation which has posed a serious problem since 2021 when the indicator started to soar. In 2022, the average inflation rate amounted to 15.1 per cent, thus becoming a galloping one. Inflation hit its peak in September 2022 when it reached 18.0 per cent year-on-year. Despite a certain decrease at the end of that year, the figure rose again in January 2023, equalling 17.5 per cent. Nonetheless, the rate returned to a gradual but stable decrease in the following weeks. Inflation was thus falling over the year to 6.9 per cent in September. The subsequent October regress was expected as it was caused by state intervention in the market prices of electricity in the last quarter of 2022 when the prices were reduced by non-market means. The October figure (8.5 per cent) was followed by a further decrease to 7.3 per cent in November and this trend is generally expected to continue. Without the effect of the statistical capture, the figures would have been 5.8 and 4.7 per cent respectively. The strongest uncertainty is linked to the beginning of 2024 as economic subjects usually adjust the prices at the beginning of a new year. Despite that, no substantial upward swing is anticipated because it would not meet the existing demand.

The decrease in inflation has been affected by the stabilisation of prices of foreign inputs and declining domestic demand. The latter makes further increases in the profit margins hardly possible if the businesses want to keep sales of their goods and services. The rise in prices of goods has been slowing down and the same applies to the prices of services, even though to a lesser degree and with some exceptions, for instance, rent. The positive trend is also caused by a year-on-year decrease in prices of fuels.[3] The official data show that inflation oscillated around zero in a monthly comparison in the second half of the year. Two months even experienced an absolute decrease in prices in the national economy. The following table sums up the YoY and MoM inflation rate in 2023 (data as of December are not available yet).

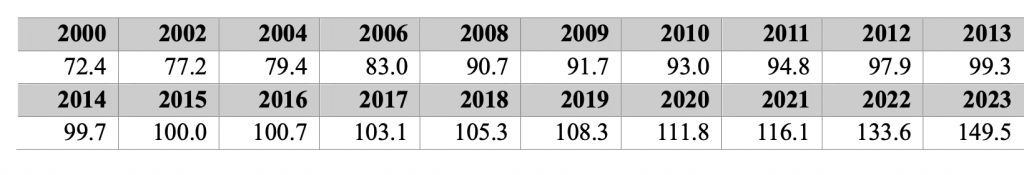

An interesting insight into the price dynamics in the Czech economy is provided by an index which takes the year 2015 as a base (=100) for comparing the price levels from a long-term perspective. The index demonstrates a considerable rise in the price level in the current decade (the 2023 figure is calculated as the average of figures from January to November).[4]

There is no doubt that the rise in inflation over the last two years was affected by the government fiscal policy which was very expansive. The main reason was the policies aimed at helping economic subjects (both companies and individuals) during the pandemic. Experts as well as state audit bodies have concluded that this kind of expenditure was excessive and its general character played a negative role in terms of the inflation dynamic. One can therefore speak about “fiscal populism” as one of the key domestic factors of the inflation crisis. However, this trend did not stop as the pandemic faded away. On the contrary, the current government, whose election programme lambasted the “fiscal irresponsibility” of the cabinet headed by Andrej Babiš, aggravated the overall economic situation in general and fiscal policies in particular.

The central bank and monetary policy

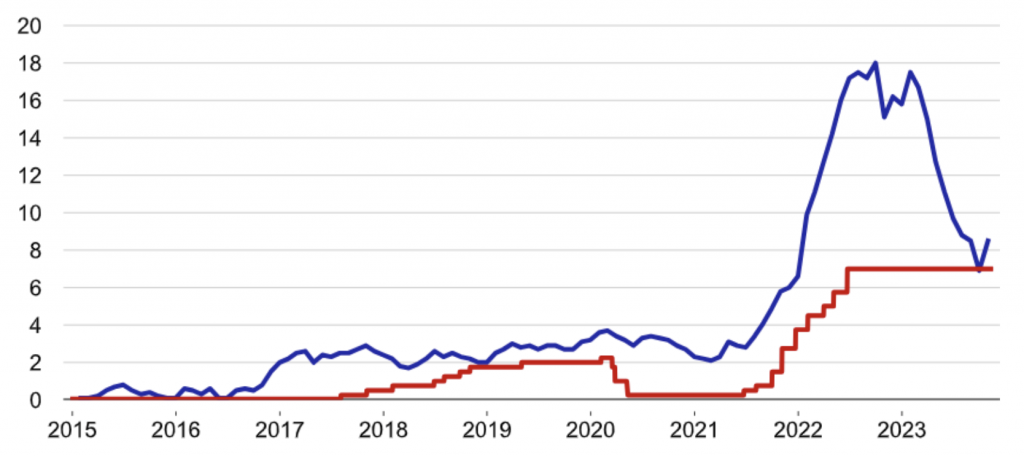

In contrast, the Czech National Bank, which has the fight against inflation as one of its legal duties, became one of the first central banks in the world to increase the basic interest rates (two-week repo rate, Lombard and discount rate) in response to the existing inflationary pressures. Between May 2020 and June 2022, the 2W repo rate was increased from 0.25 to 7.00 per cent, the Lombard rate was raised from 1.00 to 8.00 per cent and the discount rate was elevated from 0.05 to 6.00 per cent. Now it is already possible to note that the level set in June 2022 has been final as the new Bank Board adopted a “dove” stance in monetary policy and decided to keep the basic rates unchanged. Interestingly, the central bank was broadly criticised for its “hawkish” policy, which naturally had negative impacts on both households and businesses, at first while being often targeted for passivity throughout the year 2023 when the inflation rate was already declining. The basic rates may be possibly decreased at the December session of the Bank Board but even if it does not happen, one can expect a gradual decrease in the year to come. The long-term goal of the central bank is to keep inflation at 2 per cent on average and the toleration band stretches from 1 to 3 per cent. Central bankers are optimistic about the prospects, expecting that the rate will reach the toleration band at the end of 2024, decreasing to the inflation target by the middle of the year. Economists and commercial bankers are slightly more sceptical but a majority of relevant actors anticipate the figures to oscillate between 2 and 3 per cent in the longer-term horizon.[5]

Diagram: Development of inflation (blue) and the two-week repo rate since 2015

Source: Czech National Bank

The level of basic interest rates strongly affects the interest rates on the mortgage market and thus the financial situation of a large segment of society, for more than 16 per cent of the Czechs have mortgages. After the extremely low interest rates of around a mere 2 per cent in 2020 and 2021, the consumers had to adapt to the average rate of 5.6 per cent in 2022 and 6.2 per cent in 2023.[6] Both central and commercial bankers emphasise that a decrease will be slow. From their perspective, the basic interest rates could fall to 4 per cent by the end of 2024, reaching the threshold of 3 per cent a year later.[7] Naturally, the interest rates on the mortgage market will be above this level. The relatively high interest rates cooled both the mortgage and real estate market and the weaker demand contributed to stagnation of the prices of real estate. However, the affordability of housing is worse and worse and the situation can even deteriorate after interest rates become more favourable. A recent analysis published by Politico shows that house prices soared by up to 150 per cent compared to 2010 and rents experienced a rise of up to 50 per cent over the same period. Not by coincidence, Prague has become the most expensive European capital in terms of the costs needed for the purchase of an average flat in relation to the volume of an average salary. One needs more than 25 yearly salaries to buy a 75-square-metre flat in the Czech capital in contrast to 18 yearly salaries in Budapest, 12.3 salaries in Berlin or less than 8 yearly salaries in Brussels.[8]

It poses a great challenge and risk for the government and social stability all the more so that the standards of living dropped considerably in 2022 and 2023. The government has not elaborated any strategy to cope with this problem which is to further deteriorate in the next years. Ministry of Regional Development sees the only real solution in making rental housing more affordable so as to change the strong tradition of home ownership which has produced enormous demand that cannot be satisfied by the supply. The share of the homeownership amounts to 78.3 per cent, which is comparable with other post-Communist countries but very different from what is common in many West European countries. For instance, the figure is 54.2 per cent in Austria and 49.5 per cent in Germany. The concurrent rising demand for rental housing as a result of the financial inaccessibility of real estate is pushing the rents up. In 2023, the government started to discuss new regulations of the rent market inclusive of setting a minimum period of validity of tenancy agreements and legal regulation of rent fees.[9] However, the most important is a revision of the Building Act and related legal rules and institutions to make them more flexible and supportive of the construction and development. The government has failed to do so.

Government, austerity policies and protests

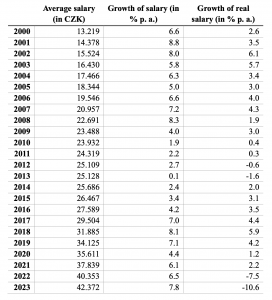

The housing question is one of the key social issues. The rising expenses on housing in conjunction with a considerable increase in energy and the long period of high inflation as such pose a serious social problem. The real average salary decreased in 2022 and, despite the lack of data for all months of this year, it is more than clear that the same applies to 2023. The rise in nominal salaries cannot change anything in this regard due to the concurrent inflation. The official statistics show that the real salaries have been declining for eight consecutive quarters since the last quarter of 2021. At the same time, the recent drop has not been fatal if one analyses the figures from a long-term perspective. The following table summarises the dynamic of an average salary since 2000. The figure for 2023 is calculated as an average of the first three trimesters.[10]

It follows that the last two years made a regress to the level of 2018. Even though it is unpleasant in itself, such a partial regress cannot erase the positive achievements reached over decades. Nonetheless, the problem is that the above data reduce and distort the social reality as the impacts of inflation are not even throughout society, having stronger impacts on lower-income groups and the middle class. Similar criticism has appeared in connection with the government fiscal consolidation measures which will enter into force at the beginning of 2024. The “consolidation package” was presented in May 2023 as one of the political priorities of the ruling cabinet. Its aim has been to reduce the state debt and revise state expenditures so as to stabilise the budget.[11] However, the final shape is rather unconvincing. The government has made some concessions to pressure groups and, overall, the measures are not of reform character, limiting themselves to adjustments in individual parameters. In contradiction to the programme declaration and pre-election promises, the cabinet has approved an increase in taxes for both consumers and companies. The structure of value-added tax will be simpler but the effect on revenues is expected to be negative, which goes against the goals set by the fiscal package. The corporate income tax will be raised from 19 to 21 per cent, chosen tax discounts will be annulled and the tax burden will be increased considerably for lower-income self-employed persons while the higher-income ones can benefit from the adjustments, which is socially controversial. Similarly, stricter rules for labour contracts will make the labour market even less flexible and it will bring negative impacts, especially for lower-income groups. In addition, property tax is about to go up. The consolidation package also includes the possibility for companies to keep the books in foreign currency (EUR, USD and GBP) and cuts in state subsidies.[12] Yet, the system of subsidies remains largely intact and it continues to distort the economy and the overall market environment.[13]

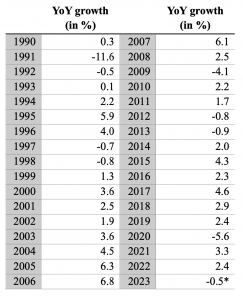

The government expects that the implementation of its restrictive fiscal measures will weaken the economic performance and lower the GDP growth by 0.3 per cent per annum between 2024 and 2026.[14] Despite the lack of data from the last quarter, one can observe that the Czech economy experienced recession in 2023. The average value amounts to -0.5 per cent in the first three quarters of the year. The latter thus joins eight other years when the Czech (Czechoslovak) economy suffered from negative growth after the fall of the Communist regime. The post-Communist period is, nevertheless, typical of decent economic growth. The table below shows that the most serious problems occurred in the early 1990s in connection with the economic transformation, in the late 1990s coinciding with the Asian financial crisis, after the global crisis in the late 2000s and after the outbreak of the pandemic in the early 2020s.[15]

It is worth noting that after the last global financial crisis, the Czech economy was stagnating for five years. The overall GDP growth amounted to 54.7 per cent from 1990 to 2022, that is, 1.7 per cent per annum. The principal question is whether the country’s current economic model will be able to deliver sufficient growth in the next years. Face to face with a very slow post-pandemic recovery, many economists have started to argue that the model has gotten exhausted and has to be updated qualitatively to overcome the pattern based on radical opening up, inflow of foreign investment, relatively cheap labour force and a role of subcontractor with a low added-value production. The existing problems indicate that the country has got into a middle-income trap.[16] The strategies as well as actions on the part of the government and state bodies do not respond to these challenges, lagging behind the socioeconomic development.

The government policies have led to growing dissatisfaction throughout Czech society. Nevertheless, there were no mass demonstrations compared to those in 2022 when hundreds of thousand people protested against the ruling cabinet in the streets. The only relevant exception was a strike held in November 2023 and organised by the trade unions. The main engine for the November protest was pressure from doctors and teachers. Even though the strike was joined by up to one million employees (that is, almost one-tenth of the population) and supported by some 64 per cent of citizens, its significance was rather of symbolic character. Interestingly, the strike was also attended by employees from such enterprises as Škoda Auto irrespective of the fact that they belong to the high-income workers. The government considered the whole action “unjustified” and “irresponsible”.[17] The incapacity to lead a reasonable dialogue with society helps us to understand the sharp decrease in public support for the cabinet. Sociological surveys indicate this trend very clearly. The Academy of Sciences has found out that a mere 17 per cent of people trust the government in contrast to 81 per cent who hold the opposite attitude (the level of distrust increased by 19 per cent compared to the spring of 2022). Similarly, 77 per cent do not trust the current Chamber of Deputies. The figure has reached 66 per cent in the case of the Senate.[18]

Conclusion

In response to the government policies, the public support for the ruling coalition was declining throughout the year and the overall dissatisfaction has hit record levels. Less than 1 per cent of people consider the political situation “very good”. On the contrary, up to 80 per cent perceive it as bad. It is worth noting that negative attitudes have been adopted by a large part of those who vote for the government parties. The figure amounts to 63 per cent (Pirates), 54 per cent (STAN), 48 per cent (TOP 09), 46 per cent (ODS) and 44 per cent (KDU-ČSL). At the same time, voters of the parliamentary opposition parties (ANO and SPD) with positive evaluation are utterly marginal (2 per cent in both cases). The hard data demonstrate that the government is broadly unwanted.[19] The only reason why the coalition is still holding together is their fear of a landslide election victory of the opposition.

[1] Mahdalová, K. (2023, December 14). Padesát nejdůležitějších slibů Fialovy vlády: Co splnila a co porušila. Seznam Zprávy. https://www.seznamzpravy.cz/clanek/domaci-padesat-nejdulezitejsich-slibu-fialovy-vlady-co-splnila-a-co-porusila-241596. Zemánek, L. (2023, March 16). Revision of the Governmentʼs Agenda. China-CEE Institute. https://china-cee.eu/2023/03/16/czech-republic-political-briefing-revision-of-the-governmentʼs-agenda/

[2] Vnitro polarizuje a vytváří atmosféru strachu, píše spolek proti cenzuře Fialovi (2023, December 10). iDNES.cz. https://www.idnes.cz/zpravy/domaci/petr-fiala-premier-vit-rakusan-ministerstvo-vnitra-spolecnost-pro-obranu-svobody-projevu-kritika-sti.A231209_145744_domaci_maku

[3] Král, P. (2023, December 11). Inflace se v listopadu 2023 v souladu s prognózou vrátila k viditelnému poklesu. ČNB. https://www.cnb.cz/cs/verejnost/servis-pro-media/komentare-cnb-ke-zverejnenym-statistickym-udajum-o-inflaci-a-hdp/Inflace-se-v-listopadu-2023-v-souladu-s-prognozou-vratila-k-viditelnemu-poklesu/

[4] Inflace – druhy, definice, tabulky (2023, December 11). Český statistický úřad. https://www.czso.cz/csu/czso/mira_inflace

[5] Téma: Inflace na ústupu (2023). ČNB. https://www.cnb.cz/cs/menova-politika/inflacni-cil/tema-inflace/index.html

[6] Swiss Life Hypoindex – vývoj (2023). Hypoindex.cz. https://www.hypoindex.cz/hypoindex-vyvoj/

[7] Zámečníková, J. (2023, November 29). Aktuální sazby hypoték: Banky očekávají snížení sazeb ČNB, Creditas už se nedočká. Hypoindex.cz. https://www.hypoindex.cz/clanky/aktualni-sazby-hypotek-banky-ocekavaji-snizeni-sazeb-cnb-creditas-uz-se-nedocka/

[8] Coi, G. (2023, December 7). Gimme shelter: Cost-of-living crisis squeezes Europe’s housing. Politico. https://www.politico.eu/article/gimme-shelter-cost-of-living-crisis-squeeze-europe-housing/

[9] Štuková, K. (2023, November 16). Česko čeká regulace nájmů. Jak to chodí v zemích, kde vlastní bydlení není kult. Seznam Zprávy. https://www.seznamzpravy.cz/clanek/ekonomika-cesko-ceka-regulace-najmu-jak-to-chodi-v-zemich-kde-vlastni-bydleni-neni-kult-239852

[10] Průměrná mzda – vývoj průměrné mzdy, 2023 (2023). Kurzy.cz. https://www.kurzy.cz/makroekonomika/mzdy

[11] Zemánek, L. (2023, June 2). “Czechia in Form”: On the Government Consolidation Package. China-CEE Institute. https://china-cee.eu/2023/06/02/czech-republic-social-briefing-czechia-in-form-on-the-government-consolidation-package/

[12] Vládní balíček opatření 2023: Aktuální obsah po změnách (2023, November 22). E15. https://www.e15.cz/konsolidacni-balicek-vlady-2023-obsah

[13] Bastlová, M. (2023, December 14). Máme hlubší problém, krize za to nemůžou, myslí si šéf NKÚ. Seznam Zprávy. https://www.seznamzpravy.cz/clanek/audio-podcast-ptam-se-ja-sef-nku-vysvetluje-jak-se-zbavit-zavislosti-na-dotacich-241676

[14] MF: Konsolidační balíček bude v letech 2024 až 2026 mírně zpomalovat HDP (2023, November 13). ČTK. https://www.ceskenoviny.cz/zpravy/2440022

[15] HDP 2023, vývoj HDP v ČR (2023). Kurzy.cz. https://www.kurzy.cz/makroekonomika/hdp/

[16] Zemánek, L. (2023, October 9). In the Middle-Income Trap: Limits and Potential of the Czech Economy. China-CEE Institute. https://china-cee.eu/2023/10/09/czech-republic-economy-briefing-in-the-middle-income-trap-limits-and-potential-of-the-czech-economy/

[17] Stávku odborů podporují dvě třetiny lidí. Polovina vládních voličů si myslí, že se premiér mýlí (2023, November 27). iROZHLAS. https://www.irozhlas.cz/zpravy-domov/stavka-pruzkum-stemmark-volici-spolu-opozice_2311271311_jgr

[18] Vládě věří šestina lidí, z ústavních institucí dopadla nejhůře (2023, December 14). Seznam Zprávy. https://www.seznamzpravy.cz/clanek/domaci-vlade-veri-sestina-lidi-z-ustavnich-instituci-dopadla-nejhure-241781

[19] Fiala, A. (2023, December 10). Hnutí ANO ve volebním modelu Kantaru zvyšuje náskok, pokles podpory je patrný hlavně u ODS. ČT24. https://ct24.ceskatelevize.cz/clanek/domaci/hnuti-ano-ve-volebnim-modelu-kantaru-zvysuje-naskok-pokles-podpory-je-patrny-hlavne-u-ods-344036