Weekly Briefing, Vol. 63. No. 2 (CZ) June 2023

Economic Recession and the Need for Austerity Measures

Summary

The economic development of the Czech Republic is characterised by several major phenomena which partially contradict each other. The economy has fallen into recession, consumption is decreasing and the sentiments throughout society have recently deteriorated. At the same time, unemployment remains extremely low and enterprises lack a labour force. Despite long-term galloping inflation and a decline in living standards, the social situation is far from crisis and social cohesion continues to be high. However, the reverse side is the rapid rise of state debt which makes the fulfilment of this year’s state budget hardly feasible and requires austerity measures.

Introduction

The Czech economy fell into recession in the first quarter of the year. This development was accompanied by a drop in retail trade in April. This indicator was below zero for the twelfth consecutive month. It implies that the purchasing power of the consumers is deteriorating and the overall financial sentiment of the population is rather negative. Indeed, the confidence in the national economy on the part of both entrepreneurs and consumers decreased in May, being lower than a year ago which is worth noticing because at that time society was exposed to immediate and unexpected consequences of the conflict in Ukraine whereas the latter has already become a familiar part of life.

Recession and galloping inflation

For the first time since the first quarter of 2021, the Czech economy has fallen into recession in a year-on-year comparison when the growth was negative, amounting to -0.4 per cent. Concurrently, the quarter-on-quarter growth remained zero. The recent data thus places the country below the EU average. This dynamic was strongly affected by the long-term galloping inflation which has depreciated and partially exhausted financial reserves and limited consumption. The expenses on consumption decreased by 0.3 per cent quarter-on-quarter and by 3.2 per cent year-on-year. The consumption of households dropped by 6.4 per cent from an interannual perspective, the behaviour of the government sector was the opposite as the figure increased by 3.9 per cent in the same period.[1]

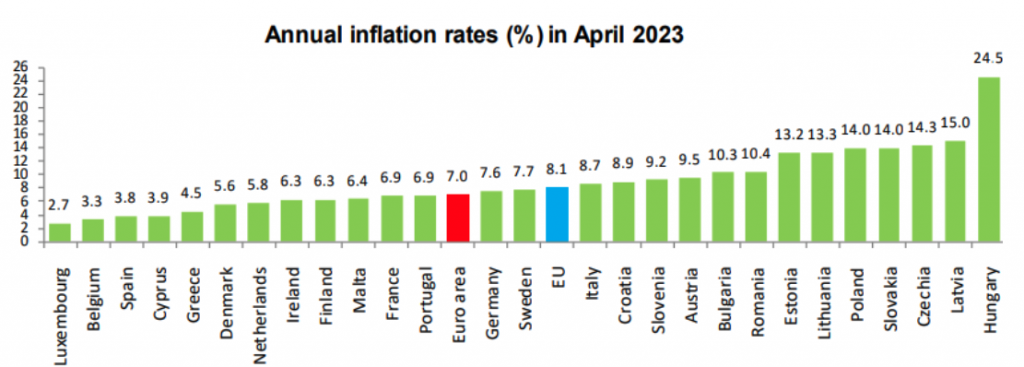

If inflation is a crucial factor in this regard, it is far from surprising that the economic performance is worse in comparison with the Western European countries where the inflation rate remains much lower. According to the Eurostat data for April (in the chart below), the Czech Republic had the third-highest inflation rate (14.3 per cent) after Hungary (24.5 per cent) and Latvia (15.0 per cent) in contrast to 7.0 per cent in the euro zone and 8.1 per cent in the EU as a whole.[2] Interestingly, the indicator equalled a mere 2.3 per cent in Russia and, on the contrary, 46.3 per cent in Türkiye.[3]

The data on the economic performance presented by the Czech Statistical Office were worse than the Czech National Bank expected. It applied particularly to the field of household consumption and fixed investment. The following table provides a more detailed perspective on the individual segments of the recent statistics together with a comparison with the central bank’s forecast.

Resilient business and the lack of labour force

Nevertheless, the central bankers interpret the actual figures in a way that they corroborate the economy’s track out of the current recession, expecting that the GDP will grow in 2023, especially thanks to a positive dynamic in the second half of the year which is to be driven primarily by the foreign trade.[4] Most economists share such an opinion but tend to moderate any expectations of higher economic growth over the next months. All the more that the sentiments regarding the Czech economy deteriorated both among consumers and businessmen in May. From a year-on-year perspective, the confidence in the economy dropped in all fields of entrepreneurship, that is, industry, construction, trade and services. The picture is somewhat different in the case of consumers where the current sentiments are better than a year ago but, at the same time, worse than in the last months which were typical of quite a rapid rise of positive expectations. Overall, both sentiments and behaviour reflect the existing high degree of uncertainty and volatility in the economic environment.[5] Not by coincidence, the retail sales decreased by 7.7 per cent in April compared to the figures from April 2022 which implies restraint on the part of the consumers. The decrease occurred also from a month-on-month perspective (by 0.3 per cent) and applied to all sectors.[6]

In contrast to these tendencies, the development of the labour market continues to be typical of very low unemployment. According to the official statistics for May, the unemployment rate further decreased by 0.1 per cent to 3.5 per cent. While the number of the unemployed dropped to 254,000 people, the employers provided 285,700 vacancies, that is, 1,200 more than in April.[7] According to the data presented by Eurostat, the Czech unemployment rate was the lowest together with the Polish one by April, amounting to a mere 2.7 per cent. It virtually did not change in an interannual comparison, for the figure was 2.5 per cent in April 2022. The situation in the Czech Republic contrasts with that in the euro area and the EU with 6.5 per cent and 6.0 per cent respectively in April 2023 (the worst situation was in Spain with 12.7 per cent).[8] It follows that the economic recession accompanied by a handful of crisis moments has not affected the labour market at all. Businesses have demonstrated resilience and stability and demand more labour force to boost their growth instead of nearing the brink of collapse which was expected by some experts, politicians and representatives of private enterprises.

Extraordinary austerity measures

Unlike the private sector, the government sector is getting to a much more serious constellation. Some of the fundamentals of the existing system have turned out to be unsustainable financially and highly ineffective. The galloping inflation has had enormous impacts on the pension system which does not presuppose such a high inflation rate and has led to significant adjustments of pensions due to its automatic indexation mechanism. It has contributed to an expansion of the state’s mandatory expenditures which, in turn, accelerates the pace of the rise of state debt. In the first quarter of this year, the state debt increased by 102.2 billion CZK (4.4 billion EUR) to 2.997 trillion CZK (127.5 billion EUR) which corresponds to 42.9 per cent of GDP.[9] At the same time, the Ministry of Finance has admitted that the state budget deficit increased from 200 billion CZK (8.5 billion EUR) in April to 271.4 billion CZK (11.6 billion EUR) in May which is an extremely negative trajectory, especially when one takes into account the fact that the approved state budget for 2023 anticipates a total deficit of 295 billion CZK (12.6 billion EUR).

In light of the recent rise is it impossible to fulfil this target which makes the minister of finance prepare additional austerity measures beyond the government consolidation package presented in May. According to economists, the total deficit could exceed the threshold of 400 billion CZK (17 billion EUR) for this year. Nonetheless, the balance will be ameliorated by extraordinary tax revenues (inclusive of the windfall tax), dividend yields from the ČEZ Group and transfers from EU funds. In the course of the first five months, the total expenditures reached 932.1 billion CZK (39.7 billion EUR), that is, 17.8 per cent more than a year ago. The largest share was spent on social benefits (357 billion CZK) and pensions (279.5 billion CZK). Both items soared in comparison with the same period in 2022 (by 16.5 per cent and 19.4 per cent respectively).[10] In response to the negative balance, Minister of Finance Zbyněk Stanjura has started to prepare new restrictive measures that are to be aimed at the ban on new state employees as well as cuts in subsidies and wages to save up 20 billion CZK (851 million EUR) by the end of this year. Such efforts will be, nevertheless, complicated by the commitments emerging from the already approved budget and opposition from individual ministries and interest groups. One of the possibilities is an amendment of the 2023 state budget which would, however, require a relatively protracted political process in the Parliament.[11]

Conclusion

The incumbent cabinet wants to improve the economic condition of the country by attracting foreign investment and a qualified labour force. Prime Minister Petr Fiala is aware that both the economic and human potential is not sufficiently utilised and further development is obstructed by outmoded patterns in education, thinking as well as business environment together with the lack of systematic and comprehensive reforms in due areas. Aside from the acceleration of opening up, an emphasis shall be put on a more efficient use and enhancement of domestic sources including technology, infrastructure, knowledge and last but not least raw materials such as lithium whose reservoirs have been discovered on the Czech territory.[12]

[1] Česká ekonomika v 1. čtvrtletí klesla o 0,4 procenta, ČSÚ zhoršil odhad (2023, May 30). ČTK. https://www.ceskenoviny.cz/zpravy/ceska-ekonomika-v-1-ctvrtleti-klesla-o-0-4-procenta-csu-zhorsil-odhad/2371925

[2] Annual inflation up to 7.0% in the euro area (2023, May 17). Eurostat. https://ec.europa.eu/eurostat/documents/2995521/16668127/2-17052023-AP-EN.pdf/624d29d7-5a2f-db4a-def2-f9deb1b8136a

[3] Russia: Inflation rate from April 2021 to April 2023 (2023, May). Statista. https://www.statista.com/statistics/276323/monthly-inflation-rate-in-russia/. Year-on-year change in Consumer Price Index (CPI) in Turkey from July 2016 to April 2023 (2023, May). Statista. https://www.statista.com/statistics/895080/turkey-inflation-rate/

[4] Král, P. (2023, May 30). GDP comes in just below the CNB forecast in 2023 Q1. Czech National Bank. https://www.cnb.cz/en/public/media-service/the-cnb-comments-on-the-statistical-data-on-inflation-and-gdp/GDP-comes-in-just-below-the-CNB-forecast-in-2023-Q1/

[5] Důvěra v českou ekonomiku v květnu klesla u podnikatelů i spotřebitelů (2023, May 24). ČTK. https://www.ceskenoviny.cz/zpravy/duvera-v-ceskou-ekonomiku-v-kvetnu-klesla-u-podnikatelu-i-spotrebitelu/2369511

[6] Maloobchodní tržby klesly dvanáctý měsíc za sebou (2023, June 7). Český statistický úřad. https://www.czso.cz/csu/czso/cri/maloobchod-duben-2023

[7] Nezaměstnanost se v květnu snížila na 3,5 %, recese trh práce nezasáhla (2023, June 8). ČTK. https://www.ceskenoviny.cz/zpravy/nezamestnanost-v-cesku-v-kvetnu-klesla-o-desetinu-bodu-na-3-5-procenta/2375932

[8] Euro area unemployment at 6.5% (2023, June 1). Eurostat. https://ec.europa.eu/eurostat/documents/2995521/16863929/3-01062023-BP-EN.pdf/f94b2ddc-320b-7c79-5996-7ded045e327e

[9] Státní dluh v prvním čtvrtletí vzrostl na rekordních 2,997 bilionu (2023, April 21). ČT24. https://ct24.ceskatelevize.cz/domaci/3580790-statni-dluh-v-prvnim-ctvrtleti-vzrostl-na-rekordnich-2997-bilionu

[10] Schodek rozpočtu se prohloubil na rekordních 271,4 miliardy (2023, June 1). ČTK. https://www.ceskenoviny.cz/zpravy/2372908

[11] Stuchlíková, L., Bidrmanová, M. (2023, June 5). Stanjura nese na vládu další škrty. Zachránit ho může trik Schillerové. Seznam Zprávy. https://www.seznamzpravy.cz/clanek/domaci-politika-kde-stanjura-jeste-letos-skrtne-20-miliard-bude-hledat-drobne-232063

[12] ČR se do budoucna musí více ekonomicky otevřít světu, řekl Fiala (2023, June 5). ČTK. https://www.ceskenoviny.cz/zpravy/cr-se-do-budoucna-musi-vice-ekonomicky-otevrit-svetu-rekl-fiala/2374593