Weekly Briefing, Vol. 35, No. 2 (BG), December 2020

Overview of the Bulgarian Economy in 2020

Like all other countries in the European Union, the Bulgarian economy in 2020 was affected by the global pandemic. The impact of the Covid-19 prompted Bulgaria to declare a State of Emergency on March 13, shutting down parts of its economy as it introduced social distancing and anti-epidemic measures. However at the onset of the pandemic, macroeconomic conditions in Bulgaria were relatively favorable. At 3.4 per cent, GDP growth in Bulgaria in 2019 was robust for the fifth year in a row, mainly driven by growing household consumption. This positive trend has been interrupted by the Covid-19 outbreak.

The State of Emergency remained in force until May 13, when it was followed by the declaration of an epidemic. That declaration has been extended repeatedly and remains in effect, with restrictions re-introduced recently due to the rising number of coronavirus infections in the country.

The spread of the COVID-19 infection in Bulgaria in the spring has been relatively limited, but the country has been under lockdown since mid-March. The economic fallout from the pandemic was widespread, affecting a large number of sectors. The government launched a package of fiscal support measures, but their effectiveness is still in doubt, especially as regards employment protection.

Containment measures negatively affected supply in sectors directly subject to them. The disposable income of households took a hit and the restrictions led to a higher saving rate. Nevertheless, the decline in consumer spending was curbed by continued wage increases and the relatively low weight in consumption of most affected services. Lower employment and subdued consumer confidence, related to the second wave the pandemic, are set to weigh on private consumption, while the government’s anti-crisis measures are expected to support private income.

Investment activity declined markedly in the first half of 2020. The reduced actual and expected business activity, combined with higher uncertainty, prompted companies to postpone investment plans. As these factors are assumed to remain in place throughout 2020, subdued investment is likely to persist.

Goods exports began to fall sharply in March 2020. Signs of recovery in exports to EU markets have been registered since May 2020, but exports to third countries have not improved. Travel services came to a halt during the period April-June and the flows have improved only slightly since then. The second wave of the pandemic is set to weigh on the rebound of exports in 2020-Q4 and 2021-Q1.

The unemployment rate has increased significantly since the onset of the COVID-19 pandemic. The government’s job retention scheme has helped to limit job losses by enabling a downward adjustment in average hours worked. The largest share of job losses was recorded in the accommodation and food services sectors. As some dismissed workers did not start looking for a job immediately, inactivity rates went up. After a sharp increase in the first half of the year, the unemployment rate is expected to level off at 5.8% in 2020.

Bulgaria has been facing the COVID-19 pandemic from a strong fiscal position and the government has put in place measures such as higher remuneration for medical and security staff, subsidies and social support schemes, with an aggregate budgetary impact of around 2% of GDP. Despite the measures and the deteriorating economic outlook, the budget in cash terms remained in surplus for about two thirds of the year. According to the Autumn 2020 Economic Forecast of the European Commission the accrual general government balance is set to turn negative reaching around -3% of GDP by the end of 2020. General government debt is expected to increase by more than 5 pps. and reach over 25¾% of GDP in 2020.

At the same time the tasks related to the mitigation of COVID-19 consequences for banks and their customers involved a considerable effort. One of the most important strategic tasks during this year was the membership of the Bulgarian currency in ERM II and accession of the country to the Single Supervisory Mechanism, by establishing close cooperation of the Bulgarian National Bank with the European Central Bank. As a result of joining the Single Supervisory Mechanism, Bulgaria also joined the Single Resolution Mechanism. From 1 October 2020, the European Central Bank exercises direct supervision over five Bulgarian significant credit institutions, and the Single Resolution Board assumed the function of a resolution authority for these institutions and for all cross-border groups. Owing to the good preparation effort, the transition to the new supervisory regime was smooth, without any turbulence for the banks and their customers.

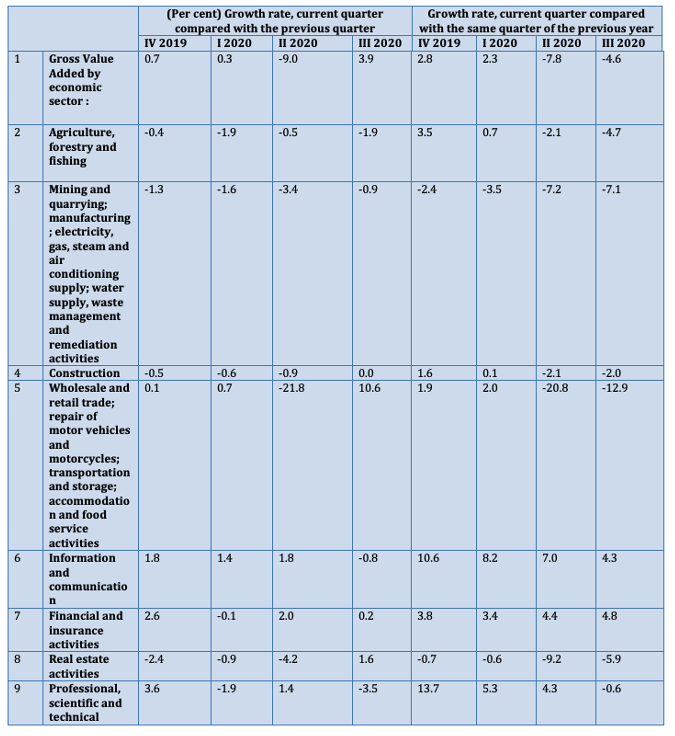

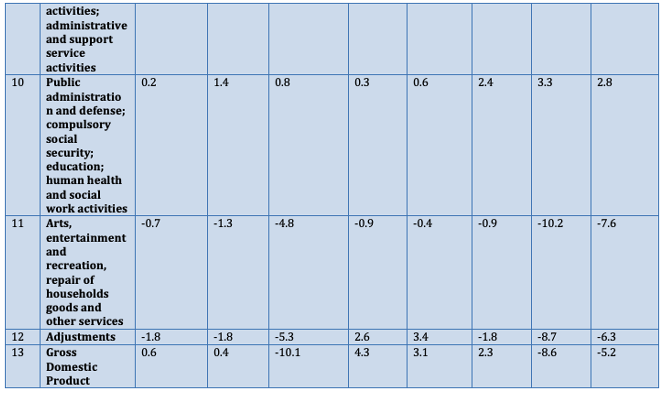

In the second quarter of 2020 Bulgaria’s real GDP fell by 10.0 per cent on a quarterly basis, reflecting the simultaneous decline in domestic demand and net exports. The containment measures introduced to curb the spread of COVID-19 in Bulgaria and worldwide were the main factor behind the very strong fall in the economic activity.

Short-term economic indicators signaled a partial recovery in the economic activity in Bulgaria over the third quarter of 2020. Easing of restrictions imposed against COVID-19 in Bulgaria and abroad resulted in a steady improvement in the business climate and consumer confidence. These developments were accompanied by increases on a quarterly basis in retail sales, turnover in industry, and construction output and services indices, and also by a decrease in the unemployment rate to 7.9 per cent in August from 8.8 per cent in May 2020 according to the Employment Agency data seasonally adjusted by the BNB.

Finally it turned out that the overall economic contraction for Bulgaria was milder than expected. Confinement measures have been less severe and the fall in economic activity lower than in many other EU countries, with economic output having shrunk by 5.2% year-on-year in the third quarter of 2020. The reopening of businesses and the relaxation of containment measures in the summer were accompanied by a recovery of activity that took on momentum in July.

Manufacturing had almost returned to December 2019 activity levels by September 2020, and goods exports have started to recover. Services, including tourism, passenger transport and retail, have been slower to bounce back. Inflation fell, driven not only by the fall in international energy prices, but also by the slowdown in core inflation and the cut in regulated natural gas and heating prices.

Unfortunately the new surge in the pandemic has affected the recovery and economic activity is expected to slow down substantially in the fourth quarter due to the growth in the number of cases from October and as the lockdown hits at the end of November.

The fiscal response has moderated the rise in unemployment. The government implemented fiscal measures to assist firms and households in March and has extended support as the impact of the pandemic endured. Financing of the measures, estimated to be about 3% of GDP for 2020, has come from national and EU resources. The government’s wage subsidy scheme has prevented a sharper rise in unemployment. It protected jobs of around 7% of the labour force in the second quarter of 2020, while helping the most impacted firms with their labour costs. Support programs are expected to remain in place for 2021 and further increases in public wages and social benefits are to be introduced. EU funding is due to be high with strong investment expected at the beginning of the next programming period in 2021 and substantial resources, of about 10% of pre-crisis GDP, to come from the EU Recovery and Resilience Facility.

In the third quarter of 2020 GDP at current prices amounted to 16 196 million EUR in total and 2 338 EUR per person. Seasonally adjusted figures show a decline of 5.2% of GDP in the third quarter of 2020 compared to the corresponding quarter of the previous year and an increase of 4.3% compared to the second quarter of 2020.

Growth rates of GDP, total and by component

(Source: Bulgarian National Statistical Institute)

A recovery is underway, but its path remains uncertain, particularly given the current large rise in COVID-19 infections. The second wave of rapid spread of COVID-19 and the new phase of the restrictive measures are once again challenging a number of economic sectors.

The first COVID-19 outbreak was smaller in Bulgaria than in many countries and the economy less severely impacted by confinement measures than expected in the first half of 2020. An economic contraction of 4.1% is expected in 2020 to be followed by a recovery, with growth of 3.3% in 2021 and 3.7% in 2022, driven by rising domestic demand and a moderate rebound in exports. Fiscal support for households and firms and high public investment are central to the strength of the recovery. Private investment will remain subdued given substantial uncertainty. Low public debt and high fiscal reserves, together with EU financial resources, will allow the government to sustain and expand its fiscal assistance. The government’s wage subsidy scheme will hopefully keep unemployment down, and rises in public wages and social benefits in 2021 will provide a boost to household incomes. With effective planning and implementation, the large EU-funded public investment program has the ability to increase potential growth.