Weekly Briefing, Vol. 33, No. 2 (SK), October 2020

Government approved state budget 2021 in Slovakia

Overview

The draft law on the state budget for 2021 was submitted to government meeting in accordance with Article 58 of the Slovak Constitution (2019) and according to §6 of Act no. 523/2004 (2020) on budgetary rules of public administration. The government approved the draft law on October, 14th, 2020. Article 58 of the Slovak Constitution (2019), financial management of Slovakia is administered by its state budget which is adopted by law as well as the revenues of the state budget, rules of budget management, relations between the state budget and the budgets of territorial units. Therefore, the state budget for the relevant budget year is approved by the National Council in the form of the State Budget Act. The Act on the state budget for the relevant budget year approves the limit of state budget expenditures, the maximum amount of the budgeted deficit or the minimum amount of the budgeted state budget surplus, if state budget revenues and state budget expenditures are not balanced. As for current budget year 2020, the Act on the state budget was approved by the National Council on December 3rd, 2019 as Act no. 468/2019 (2019). Based on the §6 (Act no. 523/2004, 2020), the state budget is an essential part of the public administration budget and provides financing for the main functions of the state in the relevant budget year. The state budget for the relevant financial year includes budgeted revenues, expenditures and financial operations with state financial assets and other operations that affect the state of state financial assets or liabilities. The state budget consists mainly of: 1. revenues broken down by chapters, 2. expenditures for the implementation of activities necessary for the fulfillment of the aims and objectives of government programs, broken down by chapters, and 3. a surplus or a deficit of the state budget if revenues and expenditures are not balanced.

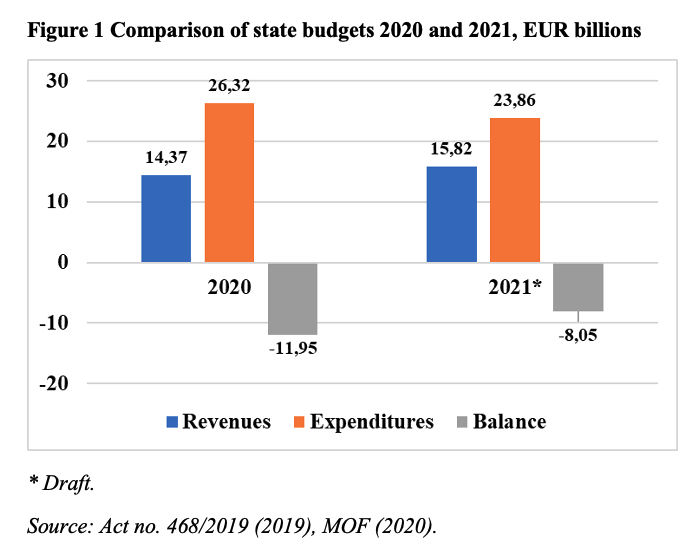

Figure 1 presents the comparison of draft state budget for 2021 and state budget for 2020 approved by the National Council in 2019. We note that the revenues for 2021 are planned at EUR 15.82 billion which is 10.1% more than in current budget year of 2020. On the contrary, expenditures are planned at EUR 23.86 billion, which is a -9.3% decrease compared to 2020 budget. Since the revenues planned are higher and expenditures lower compared to 2020, the overall negative balance (or more precisely deficit), in 2021 is planned at EUR -8.05 billion leading to decrease in the deficit by almost one third (32.7%) between 2020 and 2021.

According to VSSR (2020), public administration budget for the years 2021 to 2023 is compiled for the state budget and budgets of other public administration entities, which are included in the public administration sector by the Statistical Office of the Slovak Republic. Individual entities whose budgets form the budget of the public administration discuss their budget proposals with the Ministry of Finance. Individual public administration entities incorporate into their draft budgets financial flows from the state budget and from the budgets of other public administration entities in accordance with the draft public administration budget.

Changes over previous budget

Based on the draft state budget approved by the government, there will be changes in next year’s state budget on both sides, revenues as well as expenditures. Regarding revenues, draft proposal counts on lower incomes compared to the current period. Tax revenues from profits and income should be lower by more than EUR 1 billion in 2021. This is mainly related to the worse economy of companies. Also, the MOF (2020) expects lower VAT revenues of almost EUR 260 million and health and social security contributions, which are expected to fall by around EUR 630 million. On the expenditures side, Odkladal (2020) notes that there are several ministries that should see the increase in their budget chapters next year in case the draft proposal will pass the approval also in the National Council later this year. The Ministry of Social Affairs will improve significantly, with expenditures increasing by more than EUR 350 million compared to the previous year. This significant increase is specifically related to an increase in expenditures on the 13th pension, compensations of the social consequences of the severely disabled, as well as an increase in expenditure on family support and replacement alimony. Also the Ministry of Education will receive increase in its expenditures compared to this year by roughly EUR 170 million. These expenditures will go mainly to education reform, however, the ministry will also use some of expenditure to improve teachers’ salaries.

Possible factors affecting the state budget

According to Energieportal (2020), the risk scenario assumes a decline in GDP of 8.4% in 2020 and a recovery in economic growth in 2021 at 4.3%. In case of further waves of forced restrictions, the revenues in 2021 may be reduced by around EUR 1 billion beyond the forecast used for budget preparation. On the other hand, according to Ministry of Finance (MOF, 2020), Slovak economy should decline by 6.7% in 2020 due to the corona virus pandemics with strong decline in the first half of the year as the result of weak domestic and foreign demand. However, according to the MOF’s (2020) estimate, Slovak economy will recover and GDP will increase by 5.5% in 2021. MOF (2020) also estimates, that higher disposable income and the dissolution of savings will support household consumption and together with the recovery in foreign demand increasing exports will lead to recovery of GDP decrease of 2020. After reducing the number of jobs in 2020, MOF expects employment growth of 0.6% in 2021. Regarding wages, MOF estimates that in the post-crisis period, wage growth dynamics should resume and the average nominal wage in 2021 should reach a rate of 4.1%. In following years, wages should increase by 4 to 5% alongside the increase and strengthening of the labor market. Among the major risks of the forecasts for Slovak economy as well as for state budget is the macroeconomic development and the ongoing corona virus pandemics. In general, MOF (2020) forecasts less than EUR 2 billion in general tax revenues for 2021 compared to approved budget for 2020. This major decline in all taxes and levies will be due mainly to corona virus pandemics and its significant impact on private and public finances. The biggest shortfall in the state budget will probably be brought by the abolition of special levy on selected financial institutions from the middle of this year. On the other hand, MOF (2020) predicts increase in excise duties on tobacco products from 2021. On the risks side in the event of the next wave of the corona virus pandemics, there are economic constraints in the domestic economy as well as the possible constraints imposed in Slovakia’s trading partners. However, as MOF (2020) states, following the experience of the initial spread of corona virus, the impact on the global and domestic economy may be more modest thanks to more targeted and prudent measures in 2021 compared to 2020.

Conclusion

Preparing the state budget for next year is rather challenging task, as economic development is difficult to predict in current corona virus pandemics situation. However, as Reguli mentions in Odkladal (2020), “it is an ambitious budget that must address the recovery of the economy as a result of the current crisis. The main positive is the investment of resources in education, science and research to support innovation”. Even though the revenues for 2021 state budget are planned by 10.1% higher than in 2020 together with expenditures planned to decrease by 9.7% and overall deficit by 32.7%, the future of the state budget of Slovakia for 2021 is still not clear. The draft law was approved by the government, and will be discussed and commented in the National Council over the next weeks until it is finally approved. Also, the current situation with the corona virus pandemics may impose certain changes in particular budget chapters as well as in overall budget in the course of the year 2021. These unforeseen circumstances may lead to the decrease in planned revenues (especially in case of rising unemployment and small and medium enterprises going bankrupt which will be reflected in the revenues from income taxes) as well as to increase in planned expenditures due to safeguarding social measures taken to fight the corona virus pandemics. However, the MOF (2020) estimates the key macroeconomic indicators to move in a positive trend with increasing GDP, employment and nominal wages in the coming years.

References:

- Act no. 468/2019 (2019). Zákon o štátnom rozpočte na rok 2020. Available on-line: https://www.zakonypreludi.sk/zz/2019-468.

- Act no. 523/2004 (2020). Zákon o rozpočtových pravidlách verejnej správy. Available on-line: https://www.zakonypreludi.sk/zz/2004-523.

- (2020). Štátny rozpočet na rok 2021. Available on-line: https://www.energie-portal.sk/Dokument/statny-rozpocet-na-rok-2021-106514.aspx.

- (2020). Rozpočet verejnej správy. Available on-line: https://www.mfsr.sk/sk/financie/verejne-financie/rozpocet-verejnej-spravy/.

- Odkladal, M. (2020). Prvý rozpočet Matovičovej vlády. Kto si polepší a kto bude na tom horšie v roku 2021? Available on-line: https://www.aktuality.sk/clanok/830580/prvy-rozpocet-matovicovej-vlady-kto-si-polepsi-a-kto-bude-na-tom-horsie-v-roku-2021/.

- Slovak Constitution. (2019). Ústavný zákon č. 460/1992 Zb. Available on-line: https://www.zakonypreludi.sk/zz/1992-460.

- (2020). Príručka na zostavenie návrhu rozpočtu verejnej správy na roky 2021 až 2023. Available on-line: https://www.vssr.sk/clanok-z-titulky/prirucka-na-zostavenie-navrhu-rozpoctu-verejnej-spravy-na-roky-2021-az-2023-2.htm.