Weekly Briefing, Vol. 26, No. 2 (SK), February 2020

Changes in the consumer credits and housing loans for households

Overview

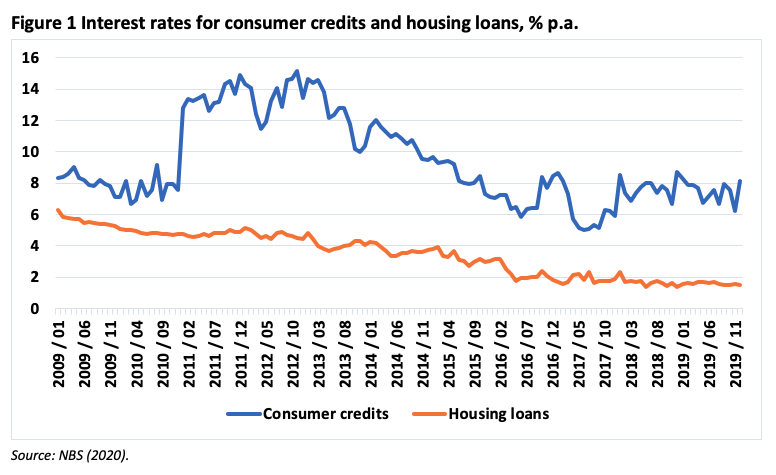

In recent years there was a growing interest of households in both consumer credits and housing loans due to the steady growing Slovak economy. However, the latest economic developments, mostly the slowing rate of economic growth, induced new measurements by the Central bank of Slovakia (NBS) regarding these loans. Figure 1 presents the development of interest rates for both types of loans in the past ten years since Slovakia became a member of the euro area. Even though there was an increase in the consumer credit interest rate between 2010 and 2013 since 2014 the rate decreased substantially and reached 8.1% p.a. by the end of 2019. Housing loan interest rate showed a decrease throughout the whole period with some negligible changes in certain months and got to 1.48% p.a. in December 2019.

Consumer credits, as well as housing loans, are governed by two acts in Slovak legislation. Consumer credits are governed by the Consumer credit Act No. 129/2010, hosing loans are governed by the Housing loans Act No. 90/2016. Consumer credit Act (2020) regulates the rights and obligations related to the provision of consumer credit under the consumer credit agreement, the conditions of the consumer credit provision, particulars of the consumer credit agreement, the method of calculating the total costs of the consumer the creditors’ terms of business and other consumer protection measures. Based on the Consumer credit Act (2020), consumer credit is the temporary provision of funds under a consumer credit agreement in the form of a loan, deferred payment or similar financial assistance granted to a consumer by a creditor. Consumer credit may be granted only by wire transfer of funds to the consumer’s payment account or to the building savings account, by postal order to which the consumer is addressed or by means of payment issued in the name of the consumer. Housing loans Act (2020) regulates 1. Rights and obligations relating to the granting of a housing loan under a housing loan agreement; 2. Conditions for granting a housing loan; 3. Housing credit agreements; 4. Method of calculating the total cost of the consumer for providing a housing loan; 5. Conditions for the performance of the creditor’s activities and other consumer protection measures associated with the granting of a home loan.

Regarding the consumer credits and housing loans, NBS states some basic points in order to obtain these types of loans:

- Applying for consumer credit (NBS, 2019a):

- consumer credit can be obtained from a bank, a non-bank financial institution or directly from the seller of the goods you are going to buy,

- consumer credit is a short-term loan,

- companies normally require no security for consumer credit, it is enough to prove that you have sufficient income to repay the loan,

- consumer credit may be used for any purpose,

- you may withdraw from a consumer loan agreement within 14 days of the date of its conclusion,

- consumer credit of up to EUR 10,000 may be repaid at any time free of charge; the early repayment of a larger loan is subject to a fee.

- Applying for a housing loan (NBS, 2019b):

- a housing loan can be obtained from a bank or a home savings bank,

- a housing loan is a long-term loan so it may have a maturity period of up to 30 years,

- the real property you intend to buy or other real property is to be pledged as security for a housing loan,

- a housing loan can be used for the purchase or construction of real property or land or for the reconstruction of a flat or house,

- you may withdraw from a housing loan agreement within 14 days of the date of its conclusion,

- a housing loan requires property or household insurance, which must be accepted by the lender even if it is purchased from an insurer other than the lender,

- if you are required to arrange insurance for loan repayment, you should check for what cases you will be insured; a housing loan may be repaid before maturity in full or in part, for a fee of up to 1% of the outstanding loan amount,

- if you repay the loan at the time of interest rate resetting, you will not be charged any fee for early loan repayment.

As for the housing loans for home buyers, NBS (2019b) declares two different types of these: 1. Mortgage loans or housing loans, which are offered exclusively by banks and 2. Building loans, which are offered by home savings banks. The main features of these types of housing loans are shown in table 1.

Table 1 Features of housing loans for home buyers

| Housing loans | Building loans |

| If you choose a loan provided for a specific purpose (which is more economical), you will have to document the use of the funds borrowed. If you choose a loan that may be used for any purpose, you will not be required to document the use of the funds borrowed, but the loan must be secured by a security interest in real property. | The interest rate charged for a building loan remains unchanged throughout the repayment period. |

| Banks also offer mortgage loans for young people aged up to 35, where the state subsidizes the borrower’s interest costs. This is tied to the condition that the borrower’s monthly income may not be higher than 1.3 times the average monthly salary. | The interest rate on such loans is somewhat higher than the rate charged for a mortgage loan because it is guaranteed by the home savings bank for the entire period of loan repayment, which may be as long as 15-20 years. |

| Banks offer loans with interest rates fixed for various periods, from one year to the entire maturity period. Decide as you are recommended and according to your willingness to take the risk that the interest rate will fall or rise in the future. | You can obtain a building loan from a home savings bank after having saved with that bank for a certain period. You can also obtain such a loan from a home savings bank without having saved previously, but under less favorable conditions than home, savers are entitled to. |

Source: NBS (2019b).

Effects of changes valid since January 2020 in consumer credits and housing loans

The effects will primarily affect low-income families with several children with disposable income less than EUR 1,400 monthly, especially if they are planning to purchase a property using a mortgage in conjunction with consumer credit. In practice, such a family will receive a lower loan than what was originally applied for. Some financial experts (Kullova, 2020) propose a significant impact of the decline in lending on 25% of new applicants, while the NBS estimates the number to be around 6%. The NBS also argues that this group of people with low disposable income are most at the risk in case of negative economic development and change (increase) of interest rates in the future. Because of the new regulations, these people will probably have to compromise, when wanting or needing a new property, by postponing the investment until they are able to accumulate a sufficient reserve or by choosing a cheaper and less suitable property.

The new regulation also aims to limit the co-financing of the housing loans with consumer credits, which have much shorter maturity and rather high monthly payments. Rather, building loans and intermediate loans, with significantly longer maturity and lower monthly payments, are a good alternative.

Conclusion

Since January 2020, it is harder to get a consumer credit based on the new measures proposed by the NBS. Introduced changes will be felt mainly by people with middle and lower incomes. After all the installments have been paid, they will have to retain a higher reserve than in previous years. The NBS substantiates that the goal is to protect people with lower incomes in the event of a crisis when this group is the most vulnerable. If there is a loss of income or a job, these people do not have enough money to pay their credits or housing loans. New measures proposed by the NBS are designed to ensure that installments absorb a lower proportion of earnings, thus creating a reserve in case the income is reduced.

Main changes in effect since early 2020 (Csernak, 2019c):

- The borrower will have to keep a higher reserve from his income than previously. After a deduction of living minimum from net earnings, the remaining amount could be repaid to a maximum of 80%.

- Since January, the total amount of repayments may reach a maximum of 60% of income after the deduction of the living minimum.

- By April 2020, as part of the transitional period, banks will be able to provide 15% of consumer credits, which exceed 60% of disposable income.

- As of April 2020, banks will only be allowed to exempt from this rule to people under 35. For them, the amount of the installments will be at most 70% of the income reduced by the living minimum. Credits with such an exception will be no more than 5%.

References

- Beracka, J. (2020). Nový rok, nové pravidlá. Ak vzrastú úroky na hypotéke, dostanete menej peňazí. Available on-line: https://www.etrend.sk/financie/novy-rok-nove-pravidla-ak-vzrastu-uroky-na-hypoteke-dostanete-menej-penazi.html.

- Csernak, P. (2019a). Ďalšia rana pre hypotéky. Centrálna banka narýchlo prijíma nové obmedzenia. Available on-line: https://www.etrend.sk/financie/dalsia-rana-pre-hypoteky-centralna-banka-narychlo-prijima-nove-obmedzenia.html?itm_site=etrend&itm_template=article&itm_area=article&itm_module=related&itm_position=2.

- Csernak, P. (2019b). NBS chce chrániť dlžníkov. Preto sprísni poskytovanie úverov. Available on-line: https://www.etrend.sk/trend-archiv/rok-2019/cislo-47/narodna-banka-chce-chranit-dlznikov-preto-sprisni-poskytovanie-uverov.html.

- Csernak, P. (2019c). NBS chce chrániť ľudí tým, že im obmedzí úvery. Available on-line: https://www.etrend.sk/financie/nbs-chce-chranit-ludi-tym-ze-im-obmedzi-uvery.html.

- Consumer credit Act. (2020). Act no. 129/2010. Available on-line: https://www.zakonypreludi.sk/zz/2010-129.

- Housing loans Act. (2020). Act no. 90/2016. Available on-line: https://www.zakonypreludi.sk/zz/2016-90.

- Kullova, Z. (2020). Štartujú tvrdšie hypotéky. Štvrtina ľudí bude mať veľký problem. Available on-line: https://www.etrend.sk/ekonomika/startuju-tvrdsie-hypoteky-stvrtina-ludi-uz-na-ne-nedosiahne.html?split=all.

- (2019a). Spotrebný úver. Available on-line: https://www.nbs.sk/sk/spotrebitel/spotrebitel/ako-si-vybrat-uver/spotrebny-uver.

- (2019b). Úver na financovanie bývania. Available on-line: https://www.nbs.sk/sk/spotrebitel/spotrebitel/ako-si-vybrat-uver/uver-na-financovanie-byvania.

- (2020). Banková úroková štatistika – úvery. Available on-line: https://www.nbs.sk/sk/statisticke-udaje/financne-institucie/banky/statisticke-a-analyticke-prehlady/urokova-statistika/bankova-urokova-statistika-uvery.