Weekly Briefing, Vol. 53. No. 3 (LVA) July 2022

How Resilient is the Latvian Society to the Coming Recession?

Summary

According to the latest data, 25.1% of Latvia’s population is below the poverty risk threshold, which is one of the worst indicators in the European Union. In addition, more than one third of the population of Latvia do not have any savings that would allow them to maintain their usual standard of living during a recession. This creates a very serious social risk at a time when the prices of energy resources are rapidly increasing, inflation is growing and geopolitical fluctuations are actively affecting how the population of Latvia will be able to spend their funds in the coming months. Latvian society is not ready for the upcoming crisis, therefore urgent and concrete solutions from the different ministries are needed.

Introduction

High income inequality and a large number of people at risk of poverty is a topic that is receiving more and more attention not only on the global stage, but also in Latvia. Income distribution in Latvia is one of the most unequal in the European Union, and the proportion of the population at risk of poverty is one of the highest in the EU – approximately every fourth resident of Latvia lives on less than 330 euros per month. In the time of rapid price increase, geopolitical instability and energy resource crisis, the question arises – are Latvian residents ready for the recession and upcoming winter months, when the peak of price rises is predicted?

I Poverty Threshold

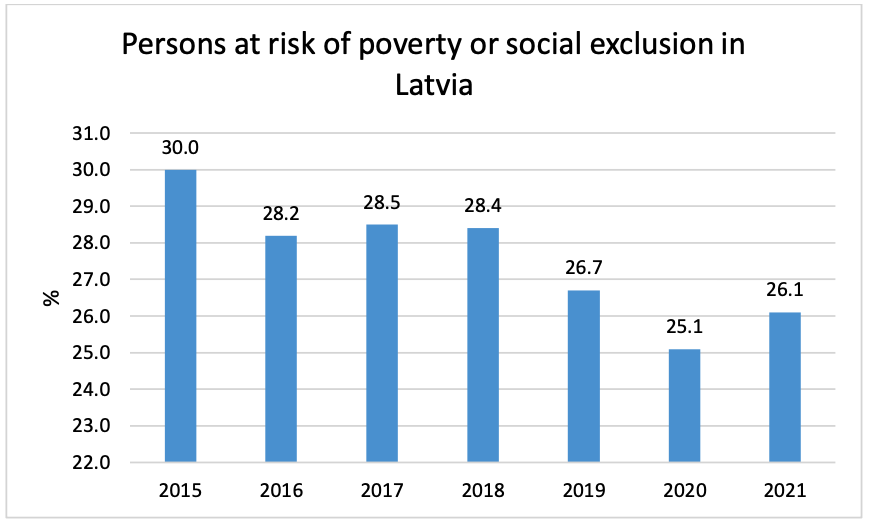

In 2020, 25.1% or around 490 thousand inhabitants of Latvia were at risk of poverty or social exclusion, which is lowest amount in the entire time period, however, due to instabilities of the Covid-19 pandemic, Eurostat predicts a rise of 1 percent point in the 2021 data revision, which is visible in Figure 1.

Figure 1.

Although the proportion of the population at risk of poverty or social exclusion has decreased since 2015, Latvia is still one of the EU member states where this indicator is one of the highest. The latest available data (for the year 2020) show that Latvia had the fifth highest proportion of the population at risk of poverty or social exclusion among all EU member states. The situation was worse in Romania, where the proportion of the population at risk of poverty or social exclusion was 35.8%, in Bulgaria – 33.6%, in Greece – 27.5% and in Spain – 27.0%.

Figure 2.

The poverty risk threshold in 2020 reached 472 euros per month for a one-person household. For households with two adults and two children under the age of 14, the poverty risk threshold in 2020 was 991 euros per month. CSB[1] data show that the highest proportion of the population at risk of poverty was in Latgale (36%) and the lowest in the Riga Region (16.1%) and in the Riga City (17.8%). In Vidzeme, 32% of the population was at risk of poverty, in Kurzeme 29.5% and in Zemgale – 24.1% of the population.

The risk of poverty increased most rapidly among the elderly over 65 years of age – in 2020, the proportion of the elderly at risk of poverty reached 44.6%. Among the population aged 50-64, the proportion of those at risk of poverty reached 24% in 2020. Pensioners (50.9%) and the unemployed (46.8%) were most at risk of poverty. The least at risk of poverty was among the working population (9.8%). CSB calculations showed that in the absence of social transfers, without providing state and local government support, including without paying pensions, 40.5% of the population would be at risk of poverty.

Analysing each indicator of the risk of poverty or social exclusion separately, the preliminary data of 2020 show that the population of Latvia is most affected by low income and its uneven distribution. Out of the total population, 26.1% were at risk of poverty or social exclusion, 23.4% – at risk of poverty, 5.1% – deep material and social deprivation, 5.5% lived in households with very low work intensity. 16.9% of the population was exposed to the risk of poverty only, 2.1% of the population was exposed to both the risk of poverty and deep material and social deprivation, and 1.2% of the population had all three indicators of the risk of poverty or social exclusion.

II Savings

More than a third or 35.2% of Latvian households had no savings in 2020, according to CSB data. Almost as much – 35.7% – household savings would allow them to maintain their current standard of living for no more than 3 months, and 29.2% – for 3 months or more.

Household savings depend on income. In the poorest population group, more than half or 52.7% of households had no savings, while in the wealthiest group, only 17.7% of households had no savings. Only 15.5% of the poorest households and 52.9% of the wealthiest households could maintain their current standard of living for three months or more from savings alone.

The quintile group is used for the analysis, which is 20% of the number of surveyed households, grouped in increasing order according to their disposable income per household member. The lowest group includes the fifth of households with the lowest income, while the highest includes the fifth of households with the highest income.

Figure 3.

As can be seen in Figure 3, half (50.4%) of the households below the poverty risk threshold have no savings, 34.9% of these households’ savings would be enough for less than 3 months, 14.8% would be enough for more than 3 months. Every third (29.1%) of households above the poverty risk threshold have no savings, 36% have savings for 3 months and 34.9% have savings for more than 3 months.

A large part (43.9%) of single seniors aged 65 and over have no savings. However, despite lower incomes, more than half of single seniors have savings – 36.3% would have enough for less than 3 months, while 19.8% of savings would be enough for more than 3 months. Families with children are more cautious, and the fewest households without savings were among couples with one child (26.3%) and couples with two children (27.2%). 39.8% of couples with one child savings would be enough to maintain the current standard of living for less than 3 months, and 33.8% – for more than 3 months.

Furthermore, at the beginning of 2022, a population survey conducted by “Luminor Bank” showed that more than a third of the population could survive with their savings for no longer than two months, while half would have enough for only one month. 24% of respondents would have enough savings for 3 to 6 months, however, it is really worrying that the fifth part or 20% of the population has no savings for unforeseen cases, which creates a very big social risk during a faster price increase.

Conclusions

Overall, more than half of the poorest households have no savings. Half of the households that are below the poverty risk threshold have no savings, and the composition of the household has also affected the existence of savings. About 1/3 of Latvia’s population is at risk of poverty and social exclusion, which is a worrying indicator in times of crisis and rapid price increases. Social transfers, which included targeted support from the state and municipalities, as well as pensions earned during life, played a significant role in reducing the risk of poverty. Without them, an additional 17% of the country’s population would be below the poverty line. The increase in the prices of energy resources is indeed rapid and will continue to increase, so first of all support is essential to help the population soften the shock of the price increase in the autumn, but it must be timely and targeted. Such support should promote systemic changes in energy consumption habits, incl. improving energy efficiency and creating savings of energy resources. The government must urgently decide on financial support mechanisms, because as the cold weather approaches, households will have to allocate twice as much money for home heating and electricity, as well as the increase in inflation and consumer prices continues to rise, so the poverty threshold may increase significantly this year. If now there are 1/3 of the country’s population without any savings and 1/3 of the country’s population is below the poverty line, and the country continues to lazily decide on support mechanisms, then the country is currently not ready for an upcoming crisis and creates serious concerns for the public about what will happen in the coming months.

References

- (2022a). Mājsaimniecības vidējais lielums kvintiļu grupās 2005 – 2021. Oficiālās statistikas portāls. https://data.stat.gov.lv/pxweb/lv/OSP_PUB/START__POP__MV__MVE/MVE010

- (2022b). Mājsaimniecību rīcībā esošie ienākumi vidēji uz vienu mājsaimniecības locekli (eiro mēnesī). Oficiālās statistikas portāls. https://data.stat.gov.lv/pxweb/lv/OSP_PUB/START__POP__MI__MIS/MIS010/

- LV. (2022). Latvijā joprojām ir viens no augstākajiem nabadzības riska rādītājiem starp Eiropas Savienības dalībvalstīm. https://www.la.lv/zem-nabadzibas-slieksna

- LV. (2021). Pērn 35% Latvijas mājsaimniecību nebija uzkrājumu. https://www.lsm.lv/raksts/zinas/ekonomika/pern-35-latvijas-majsaimniecibu-nebija-uzkrajumu.a399611/

- (2022). Ienākumu nevienlīdzība. https://www.makroekonomika.lv/ienakumu-nevienlidziba-un-nabadziba-latvija-ka-palidzet-iedzivotajiem

- Oficiālās statistikas portāls. (2022). Nabadzības risks un sociālā atstumtība Latvijā (2022). https://admin.stat.gov.lv/system/files/publication/2022-01/Nr_09_Nabadzibas_risks_un_sociala_atstumtiba_Latvija_2021_%2822_00%29_LV.pdf

[1] CSB – Central Statistical Bureau of the Republic of Latvia