Weekly Briefing, Vol. 46. No. 2 (SK) December 2021

Slovakia in 2021

Summary

The development of the Slovak economy in 2021 was marked by the ongoing coronavirus pandemic. During the first quarter, the economy recorded smaller than expected losses due to the prolonged second wave of the pandemic. A gradual easing of anti-pandemic measures started in April, which was reflected in positive developments in macroeconomic indicators as well as in positive developments in the individual components of GDP. The registered unemployment rate fell below 7% in the second half of the year from a peak of 8% in April. On the other hand, however, the harmonized index of consumer prices (HICP) rose throughout the year, driven mainly by services prices and, towards the end of the year, food prices.

Introduction

According to forecasts from the beginning of the year, the Slovak economy was expected to continue its recovery in 2021 with a return to the pre-crisis level. According to the NBS forecasts (2021a), economic growth, driven by foreign demand, was expected to reach 5% in 2021, despite a significant reduction in economic activity in early 2021 due to the prolonged second wave of the pandemic. The part of the economy oriented towards domestic demand was particularly affected. Shortages of commodities, parts and transport capacity complicated the functioning of global supply chains. Nevertheless, the export performance of the economy was projected to be strong during the first half of 2021 given buoyant global trade. It can be noted that several experts in Slovakia have expressed the view that vaccinating as much of the population as quickly as possible is a prerequisite for successful pandemic containment and a rapid return to pre-crisis levels (NBS, 2021a). As the epidemiologic situation has gradually improved, anti-pandemic measures have also begun to be gradually relaxed. Forecasts in early 2021 spoke of private consumption picking up and the economy catching up with the shortfalls of the beginning of the year, which was projected to reach pre-crisis levels in the second half of 2021.

Economic development in 2021

The economy recorded smaller losses than expected at the beginning of the year. Although the second wave of the pandemic lasted longer, the impact on the economy was milder. The difference was that during the second wave of the pandemic, global trade functioned almost unhindered. Slovak industry was thus able to produce and meet the demand for goods. In fact, the pandemic caused households to consume more goods at the expense of services. Similarly, the labor market was not as badly affected as in spring last year. The number of people on whom companies drew government support to maintain employment was lower than during the first wave of the pandemic. The strong pandemic wave and the strict lockdown throughout Q1 made it very difficult for trade and services, causing the economy to contract by 2% quarter-on-quarter (NBS, 2021c). By April, the epidemiological situation had improved sufficiently for most measures to be relaxed. Almost immediately, this translated into an increase in traders’ sales. Global component supply problems hit the Slovak industry in April. Most major players even had to stop production to a greater or lesser extent. More time spent at home caused a rise in spending on food and housing. This development was linked to the greater use of home office and the reduction in mobility. Consumption of services fell most significantly because of the closures. Businesses continued to keep investment spending to a minimum, as did households and the government. Investment activity contracted markedly at the beginning of the year, but was already gradually improving in March (NBS, 2021c).

Losses from the second wave of the pandemic were caught up in Q2 2021. GDP grew by 2% quarter-on-quarter as expected. The easing of anti-pandemic measures has improved the situation in trade and services and boosted household consumption. Industry remained a problem area, struggling with component shortages and, despite stable demand for products, companies resorted to unavoidable shutdowns. Domestic consumption pulled the economy forward in line with expectations. Households were catching up on deferred purchases from the lockdown period. In addition to essential goods, households bought also durable goods. Consumption thus quickly returned to pre-pandemic levels. It is important to note that households did not yet draw on accumulated savings and financed consumption mainly from their current incomes. The improvement in the epidemiological situation led to an increase in mobility, which brought a gradual recovery to the service sector. As the health situation improved, households could afford to socialize more and spent their resources on restaurants and accommodation. The industry encountered problems with the supply of components, which was reflected in lower exports. The global chip problem also affected Slovak producers in Q2 2021. Many companies, especially in the automotive industry, had to resort to temporary production shutdowns. Government consumption grew mainly because of increased spending on wages, goods, and services, while this development was dampened by revenue growth. Expenditure was under pressure from pandemic-related purchases of medical supplies, but also because of higher spending on goods and services (NBS, 2021b).

Catching up on economic losses in Q3 2021 was slowed by problems in the industrial sector. The economy grew by 0.4% quarter-on-quarter thanks to domestic demand. A favorable pandemic situation during the summer months and the dissipation of accumulated savings continued to support household consumption. However, the industry’s component supply problems deepened. Companies also had to contend with rapidly rising input prices, which hampered catching up on losses from the beginning of the pandemic. Households also used savings to finance consumption as inflation increasingly took a bite out of their current incomes. Accelerating price increases caused a decline in real incomes of the population. Industry suffered greatly from a shortage of components, which was reflected in lower exports. Deepening chip supply shortages resulted in recurrent production shutdowns, particularly in the automotive industry. Inflationary pressures intensified, with price increases reaching almost 5% in November. Global factors, which feed through into input prices, are the most important source of inflationary pressures. Prices of all major components of the consumer basket, except for energy prices, have been accelerating. High demand for goods and shortfalls on the supply side were feeding through into high price increases for intermediate and manufactured goods (NBS, 2021d).

The labor market situation worsened slightly at the beginning of the year, with fewer employees, especially in the public sector. However, jobs were also lost in trade and services. Inflation accelerated, but input prices did not translate into final consumer prices in the first quarter. This development was mainly driven by oil and cigarette prices (NBS, 2021c). Improving health conditions and the easing of anti-pandemic measures helped improve the labor market situation in the second quarter of 2021. Employment increased in all sectors of the economy, with the largest increases in trade and services firms. Consumer prices accelerated above 3%, well above expectations. This should be attributed to high input price growth and the opening of the economy. Prices of all inputs rose sharply on world markets, which was reflected in import prices of goods. Within the domestic economy, firms operating in services could afford to raise prices as consumer demand increased to compensate for their revenue shortfalls during the pandemic (NBS, 2021b).

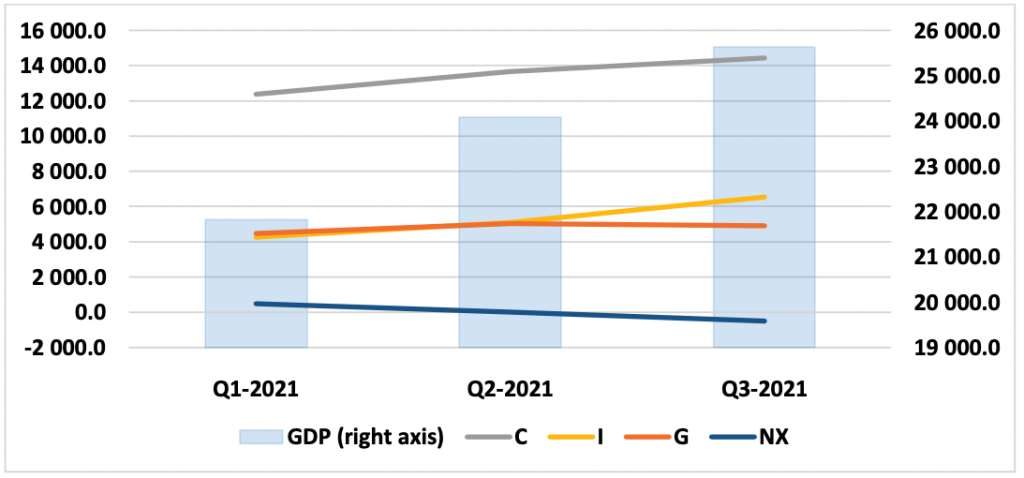

Figure 1 shows the quarterly evolution of individual components of GDP calculated using the expenditure method (left axis) as well as the evolution of total GDP (right axis). We notice continuous growth in household consumption, underpinned by the gradual easing measures from April 2021. On the other hand, however, there was a decline in net exports, which fell into negative figures in Q3, which was mainly related to developments in the global economy. The development of gross investment, which increased in Q3, is also positive.

Figure 1 GDP and its main components, current prices, unadjusted, million EUR

Note: C – Final consumption expenditure of households; I – Gross capital formation; G – Final consumption expenditure of general government; NX – Net exports of goods and services (exports of goods and services minus imports of goods and services).

Source: EUROSTAT (2022).

Figure 2 shows the evolution of the registered unemployment rate (right axis) and HICP (left axis). Looking at the figure, during 2021 the unemployment rate fell from 7.81% in January to 6.76% in December, due to a gradual easing of measures over the course of the year, especially since April, when the unemployment rate peaked at 8%. During the first 10 months of 2021, unemployment stayed above 7%, falling below that level only in October 2021, with a gradual decline to 6.76% in December. This meant that the number of registered unemployed was thus at 182.76 thousand in December. On the other hand, a significant increase in the HICP can be observed practically throughout the year, which was mainly due to an increase in some of its categories such as “restaurants and hotels”, which saw a change of almost 13% between January and December 2021. The second highest change at almost 10% was recorded in the category “transport” followed by “alcoholic beverages, tobacco and narcotics” with a change of almost 8%. It should be noted that towards the end of the year there was also a more significant increase in the price of food, which is likely to continue in the coming year.

Figure 2 Unemployment rate in % and HICP 2021, index, 2015=100

Note: M – month; Unemployment rate – right axis

Source: EUROSTAT (2022), UPSVAR (2022).

Conclusion

The performance of the Slovak economy is lagging, while we can also observe accelerating price growth of almost everything, especially towards the end of 2021. The shortage of parts for the automotive industry was more acute in the last months of 2021 compared to previous months. The pandemic situation was even worse than predicted due to low vaccination coverage and non-compliance with voluntary or state-mandated rules of prudent social contact. Influences from the global economy, which have pushed up input prices, are stronger and have caused prices of a wide range of goods and services to accelerate in Slovakia in 2021. The general government finances are expected to end 2021 with a deficit of 7.4% of GDP. The expected year-on-year increase in the deficit can be attributed to a greater need to finance the impact of the pandemic. However, the shortfall from this year should be made up by the economy in the next two years.

References

- EUROSTAT (2022). Database. Available on-line: https://ec.europa.eu/eurostat/data/database.

- NBS (2021a). Ekonomický a menový vývoj jar 2021. Bratislava: NBS, 2021. ISSN 2729-8604.

- NBS (2021b). Ekonomický a menový vývoj jeseň 2021. Bratislava: NBS, 2021. ISSN 2729-8604.

- NBS (2021c). Ekonomický a menový vývoj leto 2021. Bratislava: NBS, 2021. ISSN 2729-8604.

- NBS (2021d). Ekonomický a menový vývoj zima 2021. Bratislava: NBS, 2021. ISSN 2729-8604.

- UPSVAR (2022). Nezamestnanosť – mesačné štatistiky. Available on-line: https://www.upsvr.gov.sk/statistiky/nezamestnanost-mesacne-statistiky.html?page_id=1254.