Weekly Briefing, Vol. 39, No. 2 (LVA), April 2021

Latvia’s Capital Market Development

Summary

This briefing explains the capital market position in Latvia. For a better understanding of the situation on the market and comparison with other EU countries, a market capitalization ratio is used. Financial and Capital Market Commission developed the 10-step programme for the development of Latvia’s capital market, which provides information about possible ways of the sector development and explains why it is needed. Besides, the most significant suggestions for further development of the capital market in Latvia provided.

Introduction

Latvia’s capital market is the least developed in European Union, even neighbouring Baltic states have a thrice better performance. Significant undervaluation of the capital market has caused illiquidity of the assets. For comparative purposes, the market capitalization ratio to per cent of GDP is analysed. In this challenging situation, mature and informed decisions have to be made. Latvian Financial and Capital Market Commission (FCMC) is preparing a plan of actions to develop market capitalization in Latvia and as a logical outcome of these actions the country will be able to improve its position on the European capital market. The 10-step programme for the development of Latvia’s capital market is already available to understand, which measures are going to be implemented by the FCMC.

EU countries market capitalization comparison

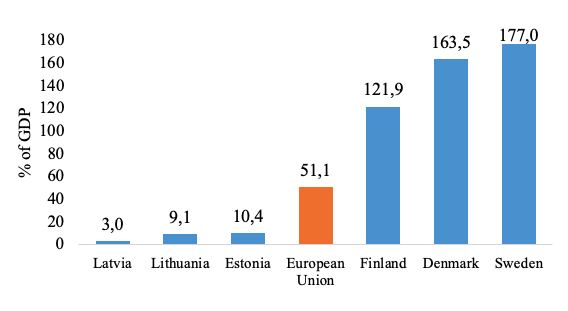

Latvia’s stock market has been facing difficulties for the last two decades, it is now considered illiquid and therefore not investment attractive. To assess the capital market development opportunities market capitalization ratio is used, which compares the value of all stocks at an aggregate level to the value of a country’s total production. The result of this calculation is the percentage of GDP, which is the market value of the stock. The market capitalization ratio in Latvia is the lowest in European Union and to have a better understanding of the situation, the ratio of the Baltic states and EU average is represented in Figure 1, as well as the ratio in the Nordic states as a benchmark.

Figure 1. Market Capitalization: % of GDP in EU states in 2020

Source: CEIS data[1] and author’s calculations

As it is seen, Latvia performs worse than all neighbouring countries, in Lithuania (9,1%), the closest ratio result to Latvia (3,0%) in this group, market capitalization ratio thrice higher. At the same time, the average ratio in European Union countries is 51,1% of GDP, which is considered as modestly undervalued. Latvian ratio is 3% of GDP – significantly undervalued and illiquid. The result of Nordic states is much higher than the EU average and for all three countries market capitalization is considerably overvalued.

Dynamics of Market Capitalization in Latvia

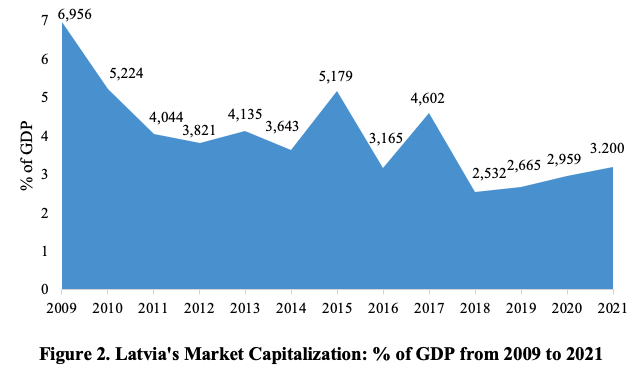

Figure 2. Latvia’s Market Capitalization: % of GDP from 2009 to 2021

Source: CEIS data[2] and author’s calculations

Based on the international standards, the market is considered fair valued when this ratio is between 75% and 90% of GDP. Figure 2 illustrates that the Latvian market was always significantly undervalued. There is no chance for any considerable improvements unless a clear strategy and state support are provided to the capital market in Latvia.

Capital market development incentives

Financial and Capital Market Commission (FCMC) at the beginning of 2021 has presented its 10-step programme for the development for Latvia’s capital market[3]. The main pillars of this programme are the role of the state in capital market development, promotion of investment opportunities and investment interest in the Baltics, and the role of issuers in attracting investment.

According to the 10-step programme, the first step is to invest in Latvia’s capital market with State-Funded Pension Scheme that will allow state capital companies to participate more actively in the capital market. Also, by the end of year 2021 should be developed support programme for issuers to help them to participate in the capital market in case they want to issue bond or share. One more idea is to promote passive investment but the options how to do it are not yet proposed. It is advisable to think about private investors attraction and more active development of platforms that bring together lending companies and private investors to develop small and medium enterprises. So, important point is to develop and promote investment service providers and create partnerships between them to increase capital market investment. The digitalization process should be boosted in both investment service providers and investment banking because usually investment platforms are able to perform on a high level in terms of digitalization and easy access, while it is not possible to say the same about tools used in the Latvian investment banking.

In 2018 the second biggest bank in Latvia started the liquidation process after United States implied strict sanctions due to prohibited transactions for North Korea and a legal case about the use of the bank by Russians for money-laundering purposes is still in the process. In the light of these events, Latvia was forced to provide much stricter laws and regulations to the industry. Now, these laws and regulations have to be reassessed because in many cases they are even stricter than regulations of European Union directives.

Besides, improvements are needed in the regulation for capital market investors protection as now existing regulation are not able to fully protect investors. At the same time, recommendations from the market players should be considered to make the regulation more viable and useful. Also, a rating system is going to be introduced by the end of 2022, to identify the most efficient issuers and promote fair competition. This process will help to make the investment process more transparent and the decision-making process for investors easier.

Of course, the main activity to develop is the promotion and attraction of investment in Latvia’s capital market. For this reason, the FCMC proposes to reassess the possibility for tax reliefs and the overall tax system during 2021 to be more competitive in the Baltic market. One of the steps for boosting investment activity is the financial literacy strategy for 2021-2027, which provide financial literacy in the field of investment for Latvian residents. In addition, it is crucial to provide information about investment risks to increase financial literacy and people with objective analysis on different types of investing, associate risk and possible returns.

What can be done to develop market capitalization in Latvia?

Market capitalization in Latvia is the lowest in European Union. Financial and Capital Market Commission is trying to improve the situation and working on incentives to promote and develop investment in Latvia. However, the field can be developed not only by governmental activities as there are innovation-oriented fintech and start-ups in the country, which were able to survive and transform during the Covid-19 pandemic. These companies are using the latest technologies available on the financial market and operate internationally, which makes it easier to attract investors from all over the world. The demand for services of these companies is stable in Latvia but the potential of the field is great and to achieve better results people need to be educated more regarding financial literacy and investment opportunities. The problem is that it is not attractive for innovative companies to go public because the capital market in Latvia is illiquid and they will not be able to sell shares for a fair price. Therefore, in order not to be significantly undervalued fintech companies and successful start-ups need to wait for the improvement of the situation on the capital market in the first place.

Latvian capital market needs to attract big investors and large enterprises should go public in the first place. For example, Latvian Railways, which is now a state-owned enterprise could be successfully privatized by a large investor and later initiate IPO process, this railway connects Europe and Russia, so investors’ interest in the company’s shares would be most probably very high and could improve market capitalization in Latvia especially if the same scheme would be used by different large companies, making the market more liquid at the same time. Besides, smaller investors would join the market after the large ones, so the attractiveness and liquidity of the market could soon reach the level of other Baltic states or even overtake them.

Conclusion

Overall, the condition of the capital market in Latvia is poor, the country performs worse than other EU countries with a market capitalization ratio equals 3% of GDP in 2020 in comparison with 9,1% in Lithuania and 10,4% in Estonia. So, Latvia has three times lower result rather than other Baltic states. The FCMC has developed the 10-step programme for the development of Latvia’s capital market, which includes suggestions for improvement of the situation. This plan is going to be developed and executed during the next several years. Besides, it was mentioned that Latvia needs to attract large investors and allow them to privatize some of the state companies to initiate their IPO process later. This will result in higher market capitalization, so smaller companies, fintech companies and start-ups will have more motivation to go public as they will not be undervalued in the changed circumstances.

[1] CEIS Data. (2021). European Union Market Capitalization: % of GDP. Available at: https://www.ceicdata.com/en/indicator/european-union/market-capitalization–nominal-gdp

[2] CEIS Data. (2021). Latvia Market Capitalization: % of GDP. Available at: https://www.ceicdata.com/en/indicator/latvia/market-capitalization–nominal-gdp

[3] Financial and Capital Market Commission. (2021). 10-step programme for the development for Latvia’s capital market. Available at: https://www.fktk.lv/wp-content/uploads/2021/01/10-step_programme_LCM_development.pdf